Your contributing member annual benefit statement will be available to view in your My Pension account by 31 August. If you have registered for My Pension, you will receive an email from us letting you know it has been uploaded to your account. If you have elected for paper communications, you will also receive a copy of your statement through the post.

Here are some frequently asked questions about the annual benefit statement. Still want more information? Why not join one of our online events or watch our pre recorded presentations.

Where can I find my annual benefit statement?

You need to log into your My Pension account. You can do this through the link in the member menu on the website. If you have any problems logging in or registering please visit our Support with my online account webpage.

Once you have logged in, you need to go to the ‘My Documents’ tile and select ‘Annual benefit statements’. You will then be able to see your most recent statement as well as those issued in previous years.

What does my annual benefit statement show?

Your annual benefit statement contains:

- the current value of your pension

- the projected value of your pension at your normal pension age

- information on your normal pension age

- details about your maximum lump sum package

- your death in service benefits

- information about tax limits

- confirmation of how your benefits are worked out.

How are the figures in my statement calculated?

Visit the What benefits you build up page on our website to find out how we calculate your benefits.

What should I do if I think the pay on my statement is incorrect?

Your pay figure is provided to us by your employer. If you think it might be wrong, please contact your employer.

**NEW** The McCloud Remedy

A new page has been included in your annual benefit statement this year with information about the McCloud Remedy, how it might affect you, and if you need to do anything.

Most members will not be affected by the McCloud Remedy, but please read the information included in your annual benefit statement carefully in case it affects you.

For more information about the McCloud Remedy, visit 'The McCloud Remedy' webpage or join one of our online ‘McCloud Remedy' events.

**UPDATED** Can I choose to access my benefits before my normal pension age?

Yes, but you will need to leave your employment to do so (unless your employer agrees to you taking flexible retirement) and you must be age 55 or older. If you choose to access your benefits before your normal pension age then early retirement reductions will apply as we will be paying your pension for longer than expected. The date you reach normal pension age is shown on your statement. The current value of your pension stated does not include any reductions that may apply.

The Government has announced the earliest age that you can take your pension will increase from age 55 to 57 from 6 April 2028. This will not apply to ill health retirements. Special rules apply if you have to retire because of ill health.

You can read more about when and When and how can you retire from employment and the retirement process on our website as well as the early retirement factors that would apply.

Can I access part of my pension?

No, not unless you take flexible retirement. Otherwise, you must take all your benefits at once.

Your employer may allow you to take flexible retirement, where you can access some of your pension benefits, and continue working in a reduced capacity while continuing to contribute to your pension. Please visit our page on when and how can you retire for more information and speak to your employer if you are considering a request for flexible retirement.What should I do if I am thinking about retiring soon?

You can use the pension calculator in My Pension to get an estimate of your pension benefits using different retirement date and conversion options. These figures are for illustrative purposes only. If you are thinking of retiring soon, you should speak to your employer who can give you a more accurate estimate and more information about what steps you need to take. We strongly suggest you check with your employer to find out how much notice they require.

For more information on when and how can you retire from employment and the retirement process please visit the pages on our website.

How does time off affect my pension?

With some types of absence, such as maternity leave or sick leave, if you have been on reduced or no pay, the pay we use to work out your benefits is the pay you would have received had you been in work (which we call assumed pay). You can read more about how absences affect your pension on our website.

Does being part time make a difference?

No matter what hours you work, or if your hours change over the year, the pension you build up is calculated on the actual pay you have earned during the year. You can read more about how working part time affects your pension on our website.

How will I know if I exceed the annual allowance?

If you exceed the annual allowance in any one tax year we will write to you to inform you and send you a pension saving statement later in the year.

Will you also send me a paper copy?

We won't send you a paper copy unless you have already asked us to do so. If you want to receive future communications by post, then you must write to us at the address below to let us know:

Guardsman Tony Downes House

5 Manchester Road

Droylsden

M43 6SF

If you need a paper copy of your most recent annual statement, please ask us for one when you write to us.

If you need a one off paper copy of this year's annual benefit statement please contact us via telephone and we will post you a paper statement.

If your needs change and you think you would benefit from receiving communications from us in a different format, for example large print, braille, audio, or on different coloured paper, please call our Customer Service team on 0161 301 7000 and we can update your record.

Are my additional pension contributions (APCs) or additional regular contributions (ARCs) included in my statement?

The pension figures in your statement include any APC or ARC contracts you may have purchased or are still paying contributions.

ARC contract – any contribution to an ARC this year or in a previous year is not shown separately on your statement, but is included in the current and projected pension figures.

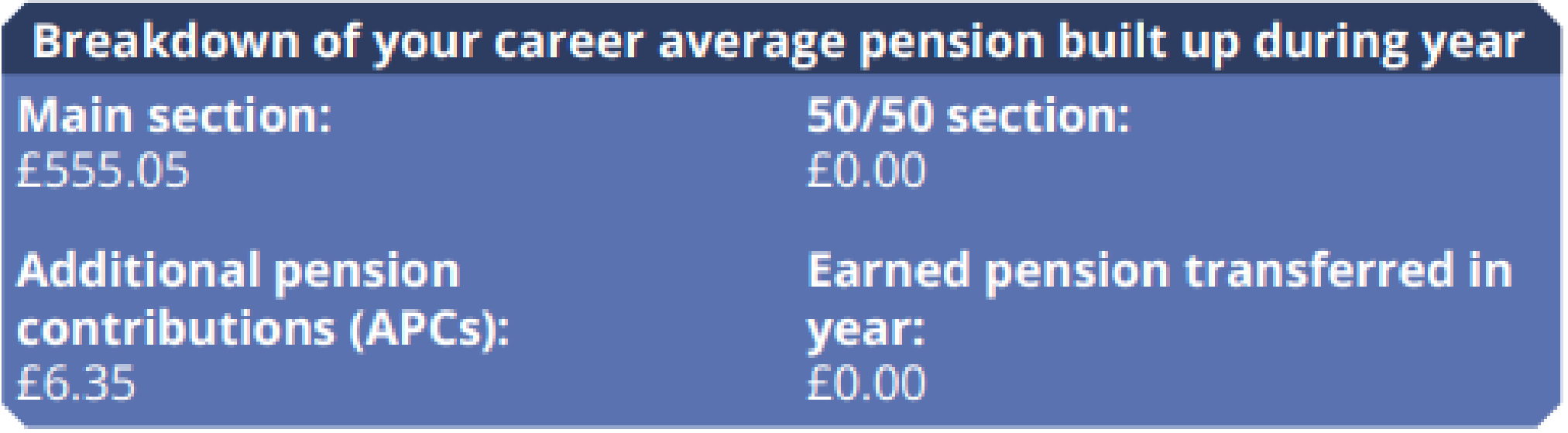

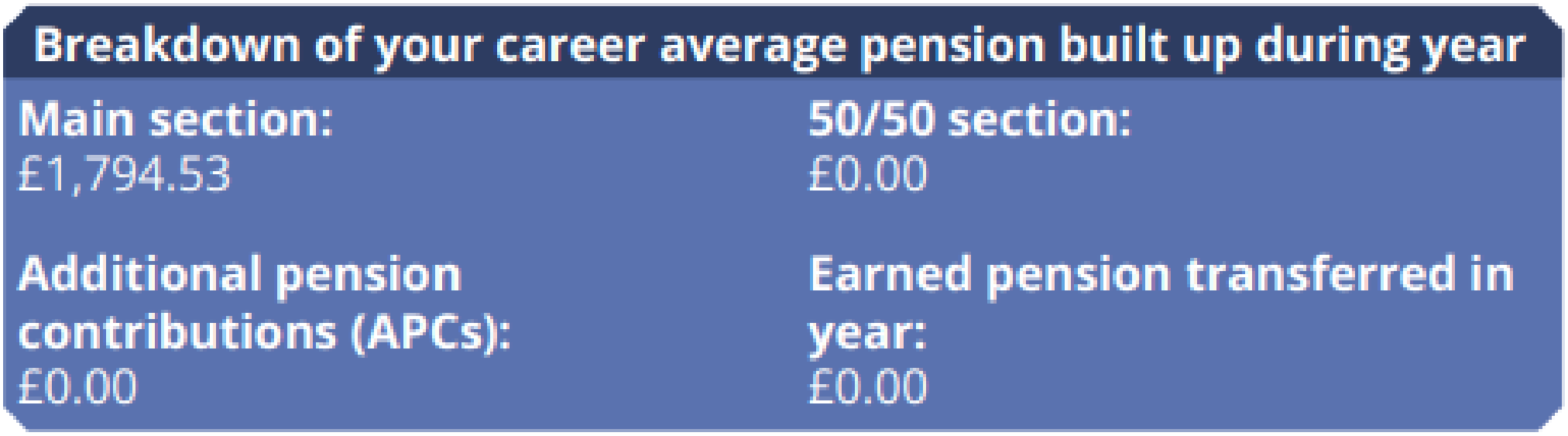

APC contract - if you have paid contributions to your APC in the last financial year, this will be shown in the breakdown of your career average pension built up during the year.

If you have completed your APC in a previous year this will not be shown in the breakdown, but is included in the current and projected pension figures.

If you pay additional voluntary contributions (AVCs), your AVC provider will send you a separate statement about its value.