How can I access my benefits on hold?

We will put your benefits on hold if you leave or opt out of the Greater Manchester Pension Fund (GMPF) before your normal pension age (NPA) and have been a member for more than two years. We call this deferring your pension.

The date you left GMPF will determine your NPA:

- After the 1 April 2014 – NPA is linked to your State Pension age (SPA).

- Before 1 April 2014 – NPA will be 65, or earlier in some cases.

We will produce a statement for you each year to tell you the current value of your benefits on hold and what your NPA is. You can find this in your online My Pension account. Your benefits on hold are revalued each year in line with the consumer price index (CPI) and are then paid in full at your NPA.

If your benefits are on hold because you opted out rather than because you left your employment, we cannot pay your benefits to you as a pension until you have left your job (the employment that you opted out of).

Can I access benefits on hold before my normal pension age?

Yes.

You can currently choose to take benefits on hold from the Local Government Pension Scheme (LGPS) anytime from age 55. The Government has announced the earliest age that you can take your pension will increase from age 55 to 57 from 6 April 2028. This will not apply to ill health retirements. Special rules apply if you have to retire because of ill health. However, we will normally reduce your pension to reflect the fact that we will be paying it for longer than we expected.

The easiest way to think about this is to think of a pension pot like a birthday cake. If we are going to pay your pot for 20 years then we cut the cake into 20 equal slices. But if you want to take your pension five years early, then we would need to cut it into 25 equal slices. Each of these slices will therefore be slightly smaller in size. If you wanted to take it 10 years early, then we would cut it into 30 equal slices, meaning each slice is smaller still.

The reductions applied to your pension reflect the amount of extra time that we are expecting to pay your pension for.

Example

Mr Jones decides to access the benefit he has on hold at age 59. His NPA is 65, so we will be paying his pension for six years longer than if he took it at NPA.

His benefits on hold pension is currently £2,000 a year. The reduction factor that applies to him (using the early retirement tables) is 25.7 per cent. This applies to all his pension pot. Therefore, the reduction he will receive is £514 meaning his annual pension to be paid from age 59 is £2,000 - £514 = £1,486.

Different reduction factors might be used if you were paying in before April 1995 or before April 2014. If you were a member of the Scheme before 1 October 2006, you may have some protection to your benefits under the 85 year rule. Therefore, it is best to use the pension calculator on your online My Pension account to work out how the reductions might affect you.

Can I take a bigger lump sum?

If you joined after 1 April 2008, then you won't have an automatic tax free lump sum. However, you can take up to 25 per cent of the overall value of your pension amount as a tax free lump sum. You must normally take all of your benefits at the same time.

You can choose to take your standard pension benefits, the maximum 25 per cent lump sum, or any amount in between.

For every £1 of pension you give up, you can get an extra £12 back as a lump sum which is tax free. The amounts may change if you have tax free cash from other pension schemes. It does not take account of any additional voluntary contributions (AVCs) you have with us, and you may be able to take some or all of your AVCs as tax free cash.

You can view both your standard and maximum lump sum figures via your MyPension account. Alternatively, you can work out your maximum lump sum figure by using the standard figures from your annual benefit statement and visiting the calculate your maximum lump sum page.

What do I need to do to access my benefits?

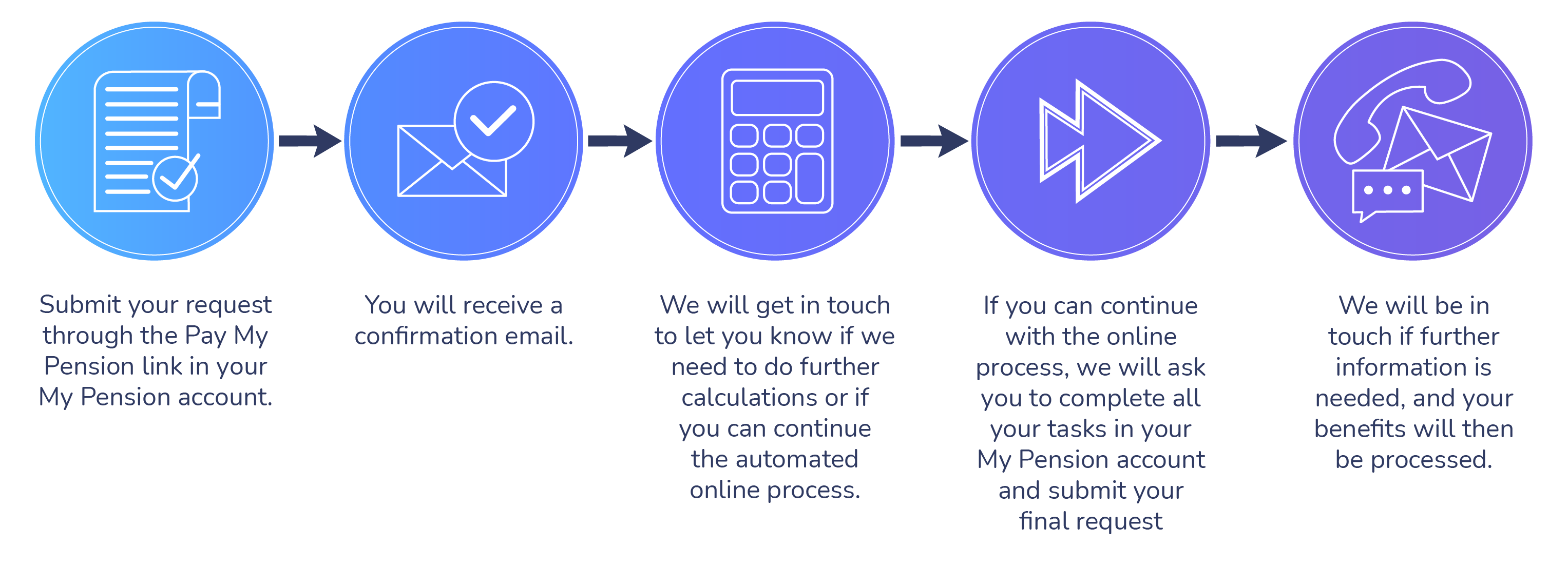

You can login to your online My Pension account and use the calculator at any time to check the estimated amounts that would be paid to you on the date you are thinking of accessing your benefits. If you want to go ahead, you can request an offer of your benefits through the 'Pay my Pension' option on the homepage of your online My Pension account. Alternatively, please use the contact us page to let us know and we will be in touch.

If we don’t hear from you before your NPA then we will get in touch with you around that time to see when you want us to pay your benefits to you.

You can choose to take your benefits anytime up to age 75.

If you choose to leave your benefits on hold after your NPA has passed, they will be paid from the date you start to receive them. Your election cannot be backdated to an earlier date.

How do I access my benefits using my online My Pension account?

To request your benefits through your online My Pension account, on the homepage select Pay my Pension. On the Pay my Pension screen you can recalculate your benefits, amend your retirement date and review your lump sum choices. To submit your request, press ‘Begin payment request’. You will then be asked to confirm your marital status and contact details.

An alert will appear on screen to confirm that your request has been received and you should also receive email confirmation (please check your spam folder). We will get in touch if we need to do any further calculations or when your tasks are available to complete in the ‘Your Tasks’ area of your online My Pension account.

You can find ‘Your Tasks’ in the drop down menu in the top right hand corner. When completing your tasks you can visit our 'Support with my online account' page if you need help with uploading documents. We will not be able to process your request until all tasks have been completed, and you have clicked submit on the Task summary page.

You cannot submit a request with a retirement date before the date of your 55th birthday.

I have sent in my retirement paperwork, when will I receive my lump sum?

We can only begin to process your pension payments once we have received your completed forms and evidence of identity and address.

Once your payment has been processed by us, providing you have passed your chosen retirement date, we aim to pay your lump sum shortly afterwards.

Both your pension and lump sum payment will be delayed if you have made additional voluntary contributions (AVCs). Before we can process your benefits, Prudential must disinvest your AVC amount. This can take up to one month from the date that we have received your completed paperwork and notified Prudential (or one month from the date of retirement if this is a future date). Once Prudential have disinvested the amount, we can then proceed with the timescales as detailed above.

Does my pension increase once it is being paid to me?

Yes. It will be reviewed in line with price rises in the same way as when it was on hold. The consumer prices index (CPI) is the index used to do this and pensions are increased annually each April. It is possible that some years there might be no increase due if prices have stayed the same. But your pension won’t go down if prices go down.